What is Fixed Asset Management Software?

Fixed assets make up a considerable chunk of a company's investments, and maximizing return on investment (ROI) is essential for every business. Fixed assets include buildings, computer equipment, software, furniture, machinery, office equipment, and vehicles. Meanwhile, intangible assets include patents, licenses, copyrights, land, and leasehold goods.

To increase corporate efficiency and lower procurement costs, effective asset tracking is crucial. This is where fixed asset management software comes into play. With the right software, companies can easily track and manage their fixed assets, ensuring that they are being used to their full potential.

Apart from increasing efficiency, fixed assets also play a significant role in accounting, helping firms claim tax benefits by recording them in their account books. By using fixed asset management software, companies can easily calculate depreciation and other tax-related benefits, ensuring that they stay compliant with accounting regulations.

What is Asset Depreciation and how it works?

Asset depreciation is the gradual decrease in the value of a fixed asset owing to wear and tear, obsolescence, or other reasons. There are several ways for calculating depreciation, including the straight-line approach, the decreasing balance method, and the sum-of-the-years 'digits method.

The straight-line approach is the most basic and often used method. It calculates depreciation by dividing the asset's cost by its duration of use. For instance, if you spend $10,000 on a machine with a five-year lifespan, the yearly depreciation expenses via the straight-line technique is $2,000 ($10,000 divided by 5 years).

The declining balance method calculates depreciation based on a fixed percentage of the asset's book value each year. This method typically results in higher depreciation in the early years of the asset's life and lower depreciation in later years.

The sum-of-the-years'digits approach computes depreciation based on the total number of years the asset is functional. For instance, if you buy a machine with a five-year lifespan, the total of the years' digits is 15 (1+2+3+4+5). Depreciation would be determined as 5/15 of the asset's cost in the first year, 4/15 in the second year, and so on.

By using one of these methods to calculate asset depreciation, businesses can track the decrease in value of their fixed assets over time. This helps them determine when to replace or upgrade assets and can help reduce tax liabilities by accurately calculating depreciation expenses. Investing in a reliable fixed asset management software can make calculating asset depreciation easier and more accurate.

Overall, managing asset depreciation is crucial for businesses to optimize their investments and increase profits. By tracking asset depreciation, businesses can determine when to replace old assets or purchase new ones, as well as reduce their tax liabilities. Therefore, it is essential for businesses to invest in reliable asset management solutions that offer effective depreciation tracking capabilities.

Why Manual Asset Management is Bad for Your Company

Manual fixed asset management can be a daunting task for businesses, especially as the volume of data grows. Here are some of the reasons why manual asset management can decrease efficiency:

High volume of data: Fixed asset management requires a considerable amount of documentation, and as a company grows, so does the volume of data. Managing a high volume of data can be a challenging task for any business, making it difficult to keep track of all assets and their relevant information.

Lack of accountability: Part of the asset management process involves moving assets to different locations or disposing of them. Any errors in registering this information can prevent the organization from effectively utilizing its assets. Manual asset management can increase the risk of human error, resulting in a lack of accountability in the asset management process.

Unplanned maintenance: Sticking to a regular maintenance schedule is crucial to extending the life of assets. However, maintaining consistency with maintenance activities can be a significant challenge in asset management, resulting in higher maintenance costs for organizations that do not plan ahead.

More auditing time: Organizations that use spreadsheets for asset management are prone to making mistakes, which can be easy to overlook. Higher error rates and inconsistencies in the asset management process can complicate auditor work, resulting in more auditing time and additional costs for the organization.

Why You Should Invest In a Fixed Asset Management Software

Investing in fixed asset management software can offer a range of benefits that optimize fixed asset investments. Here are some reasons why you should consider investing in fixed asset management software:

-

Improved efficiency: Fixed asset management software automates the asset management process, saving employee time when it comes to inventory management, maintenance planning, project management, and accounting.

-

Cost savings: By maintaining existing assets and avoiding unnecessary equipment purchases and upgrades, businesses can save money and increase their financial strength.

-

Accurate record-keeping: Fixed asset management software ensures accurate record-keeping, reducing the risk of human error and facilitating audits.

-

Better decision-making: By providing detailed spend analysis and helping businesses make informed purchasing decisions, fixed asset management software can help reduce unnecessary costs and increase efficiency.

Moreover, here are some of the benefits of using fixed asset management software:

-

Maintenance planning and scheduling: Asset management software allows companies to plan and schedule maintenance and calibrations, lowering the asset's depreciation rate and extending its life.

-

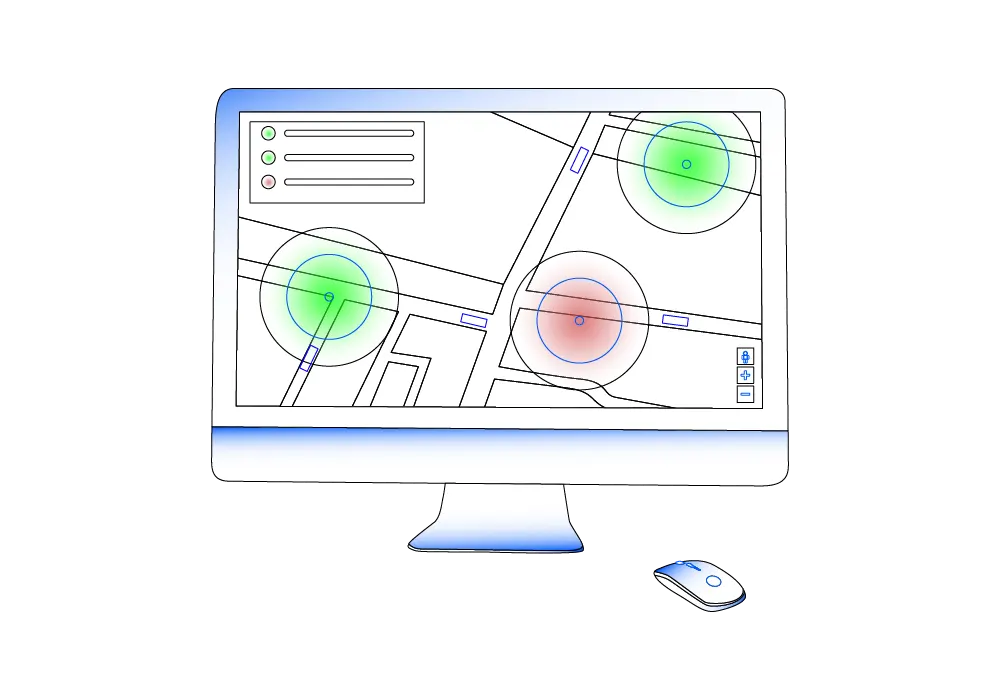

Location tracking: Asset management software has location-tracking tools that enable businesses to keep track of their assets' physical locations, reducing the risk of misplacing equipment or theft and allowing assets to be located quickly.

-

Centralized data: Fixed asset management software enables businesses to centralize all asset data, simplifying and adding value to the auditing process and keeping all data from the time of purchase to the present state of the asset.

-

Depreciation calculation: Asset management software maintains all the details of the financial documents necessary to calculate the depreciation rate, reducing the risks of human error and simplifying the process.

-

Identification of "ghost" assets: Asset management software can identify lost, stolen, or withdrawn assets that may still be on a company's books, reducing errors and ensuring accurate records.

If you're in the market for a fixed asset management software, it's important to consider factors such as ease of use, scalability, customization options, and customer support.

In conclusion, investing in fixed asset management software can help optimize fixed asset investments and offer a range of benefits, including improved efficiency, cost savings, accurate record-keeping, and better decision-making. Consider the factors mentioned above and choose the best fixed asset management software that meets your business needs.

Keeping track of your fixed asset can be very tiresome and difficult, and can cost a fortune for your company, if not done right. With the right fixed asset management software, you can improve efficiency and financial strength. Check out our super effective asset tracking solution we offer and feel free to contact us for more information.